What's Left for Quants on Wall Street?

The article will point to various examples of automated trading strategies and raise questions about where any investor, institutional or otherwise, ought to invest resources in pursuits of alpha.

What can you do for free?

A few years ago, I wrote a book called Automated Trading with R with Springer/Apress. It intended to be a sort of gateway drug for for aspiring quants. It used a friendly programming language, was chock full of free resources, and brought readers just to the cusp of trading real money.

It initially did really well, capturing a few Amazon bestseller badges in its category. People regarded it as a "expert's" guide to automated trading, because it fleshed out a lot of very practical (and sometimes boring) technical issues related to automated trading. Unfortunately, the Yahoo Finance API was deprecated, so many of the programming examples no longer work. It has racked up a good amount of one-star reviews since then.

But, I digress.

The existence of my book raises an important question for quants on Wall Street. If a determined retail trader can build an automated swing trading strategy with free resources, how much farther does Wall Street need to go to outperform them?

What can you do with unlimited resources?

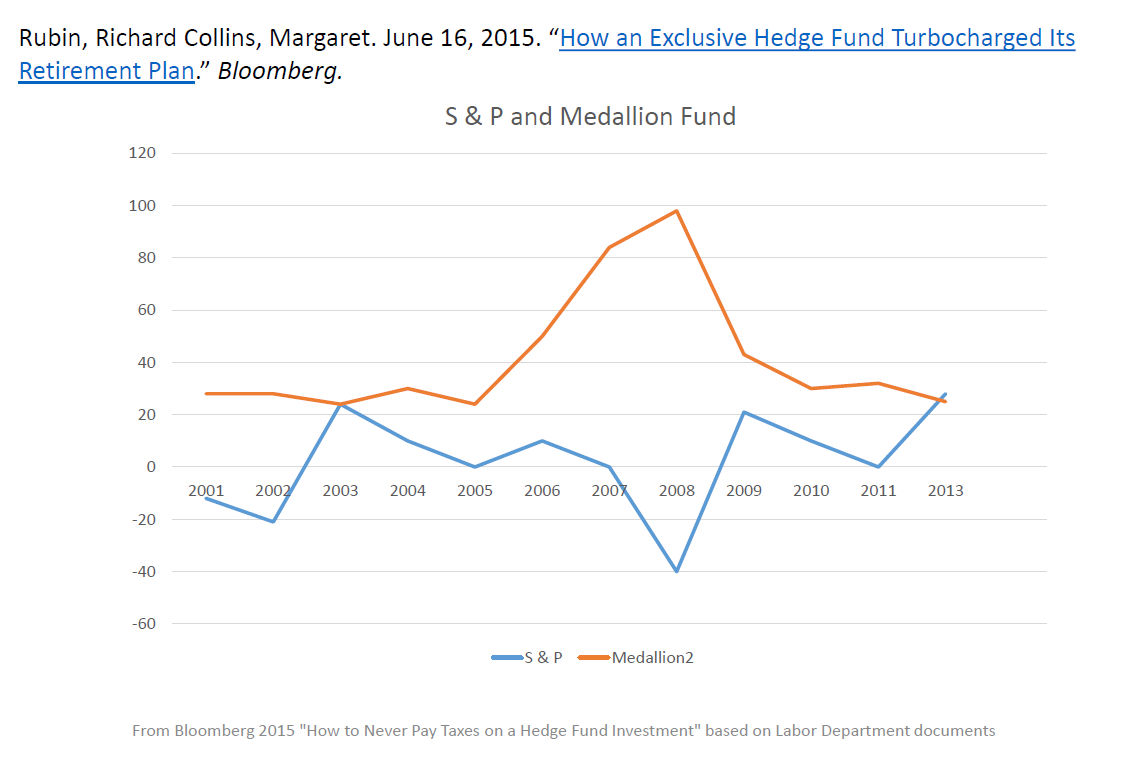

Bloomberg has written frequently about Renaissance Technologies, often calling it the "blackest box in all of finance."

They are fabled to achieve their amazing returns by employing a few hundred physicists, mathematicians, and signal processing experts to build and maintain a massive data processing pipeline running predictive analytics on stock prices. They supposedly process a few petabytes of new data every day (as in a few million gigabytes).

Reporting about RenTech in the media often gives the impression that they have superior math at their disposal. In other words, lowly retail traders are busy using MACD lines while RenTech is using advanced number theory. In reality, data drives their superior performance.

RenTech was using alternative data way before it was cool. They were collecting and organizing every bit of information available to them and making good use of it. Now, utilizing alternative data is standard practice in the hedge fund world. There is a mature industry around collecting it from a multitude of automated and non-automated means. For example, this gentleman in Japan surveys video game stores to try and predict Nintendo's sales pre-release, and hedge funds love him. They pay up to $20,000/yr for his reports.

What problems are investors having?

Well, as far as I can tell, the alternative data approach is what gives investors an edge in highly competitive and open markets like equities.

The alternative data market has become so massive that hedge funds can't simply buy up everything available. The decision of whether or not to buy any data set is not trivial, because the market is competitive and expensive. Also, almost every alternative data offering is a real-time subscription based service. So, each additional subscription permanently dents your bottom line, more or less.

To make matters worse, alternative data products can be very time sensitive and can be made obsolete overnight by laws, terms of service changes, and simple market priority changes. For example, if Nintendo decides to invest heavily in the enterprise gamification space, how does our gentleman from the previous example keep up? He might not be able to, and, if he can, he might not be able to move quickly enough to matter.

The "Roll Your Own" Era

What do you when data sources, data priorities, and data quality are constantly in flux? Well, you can't really do anything except roll your own solution and stay flexible. By "roll your own", I mean, operate like RenTech.

Hire programmers and data scientists that continually monitor, improve, and update your alternative data pipeline. Focus one reducing dependencies to outside vendors' alternative data operations. As much as you possibly can, build your own data collection pipelines from sources that you control (or are at least open to everyone).